Self-assessment as per the SWIFT Customer Security Controls Framework (CSCF): Annual assessment of the Swift environment for mandatory and advisory controls.

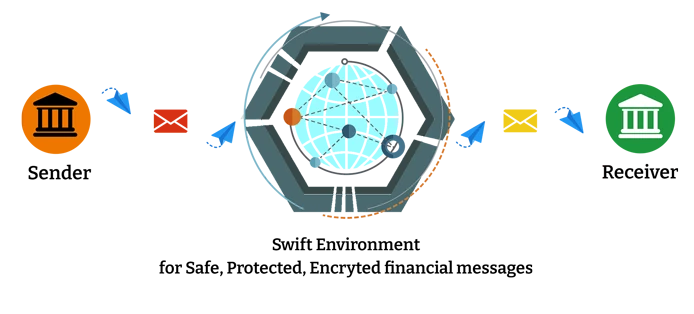

The Society for Worldwide Interbank Financial Telecommunications (SWIFT) has put forth a security framework under its Customer Security Program i.e. SWIFT CSP for all of its users to address the growing needs of security and transparency as a community to combat the increase in cyber fraud.

The SWIFT CSP program aims at detection and prevention of fraudulent activity by means of a set of mandatory security controls defined under SWIFT Customer Service Control Framework (CSCF) and community wide information sharing initiative. The framework defines a set Objectives, Principles and Controls, revised and reviewed annually.

Any organization that makes use of the Society for Worldwide Interbank Financial Telecommunication (SWIFT) interbank messaging network needs to comply with the new cybersecurity standards - as well as a related "assurance framework”. The organization that requires to be SWIFT qualified needs to undergo the following steps :-

-

-

Self-attestation as per the SWIFT Customer Security Controls Policy: Each user is required to submit a self-attestation of their compliance against the controls defined based on the assessment results before the annual deadline.

-

Third Part Attestation

Furthermore, to enhance the overall integrity of attestations across all customers, all submitted attestations for CSCF v2023 must be supported by an Independent assessment – either internally, by a second or third line of defence (e.g. risk,compliance or internal audit), or externally, by a third-party.

All SWIFT Customers are required to perform an “Independent Assessment” as per the requirement of their annual self-attestation. As an approved SWIFT Assessment Provider, QRC will help you validate successful alignment of controls with the SWIFT CSP guidelines and work alongside your internal audit function. Our extensive SWIFT CSP expertise will ensure that all your requirements are met ahead of SWIFT’s required independent assessment.-

+91 9594449393

+91 9594449393 +1 4847906355

+1 4847906355 +63 9208320598

+63 9208320598 +44 1519470017

+44 1519470017 +84 908370948

+84 908370948 +7 9639173485

+7 9639173485 +62 81808037776

+62 81808037776 +90 5441016383

+90 5441016383 +66 993367171

+66 993367171 +254 725235855

+254 725235855 +256 707194495

+256 707194495 +46 700548490

+46 700548490